Given the complications, bookkeeper and accountants involved while self-employed from 2013-2018, I was lucky to submit by the extension date. So, I literally patted myself on the back after pressing “Submit” to e-file my taxes on Mar. 17—a whole month early this year!

I immediately went to my email to double confirm a receipt from TurboTax. At the top of my inbox, I saw The New York Times email with “Breaking News: Tax Day Delayed to May 17, I.R.S. Says.” Well, I’ll be, I giggled to myself.

Instead of upset, I was even more delighted in my accomplishment and hustle—an ode to one of the themes of the last year: Carpe dime, er, Carpe Diem.

Seizing the day is a lot easier when one has abundant means. Or nothing to lose? Nah, basic needs almost always override the gumption needed to pronounce “Oh Captain, My Captain” and throw caution (or budgets) to the wind.

Knowing this all too well, and also knowing the nourishment needed to make it through hard times, seizing the day was a tricky balancing act last year. Especially for those of us who were under- or un-employed during the pandemic. I put my optimistic faith in lean habits accrued from Buy Nothing during 2016 to 2019 and more recent accounting systems for autopay and savings accounts. I knew I needed to spend as little as possible while staying committed to sustainable purchases. I also reverted to the less productive habit of avoiding reconciling my accounts for months at a time.

I justified this as a way of staying present in the moment, meanwhile, a quote kept echoing in my head from Karen McCall in her excellent guide to Financial Recovery based on her own debt experience:

“Being disconnected from your money behaviors reflects being disconnected from yourself. It causes you to act in ways that contradict your own best interests. It sabotages your progress to your goals.”

When my W-2s and 1099G started showing up and I had to confront my Mint account and budget spreadsheets, dusty fears based on not-so-past experiences appeared: Would I owe a lot? More than was in my savings? Had I made a big mistake somewhere? Had I sabotaged progress on my life goals?

After a couple weeks of convincing myself to keep sitting down every day—logging in to be accountable for my choices—there was a deep sigh of relief to see I was still going in the right direction. Even if a bit slower than I had forecasted six months ago when I landed full-time employment.

“Going slowly in the right direction is enormously better than going in the wrong direction at any speed,” Karen McCall also wisely wrote.

In subtle ways, my accounting matched my experience of the year overall: blessed and congruent.

Lower than expected:

- Gas: 30% under budget

- Parking 40% under budget

- Haircuts: 75% under budget

Higher than expected:

- Shipping: 4x more**

- Shopping: 100x more*

- Take out: 3x more

Overall, 2020 was a net positive: I came in ~15% over budget and ~17% over in earnings.

It was not this way for everyone. I have been there too.

The biggest blessing: getting to use the stimulus checks to continue payments toward my self-employment debt. Just three years after contemplating bankruptcy, I’ve only got 20% left to go (that’s including 8-16% interest rates!) with an expected payoff by my birthday this summer.

The biggest congruency: Finding harmony in conforming to the circumstances or requirements of the situation by sacrificing and staying close to home.

All in, the three “over budget” categories above totaled about $3,500. This was a little surprising. Even conscious little purchases add up. What if I had done a 5th year of Buy Nothing and that was $0 instead? Would I be closer to my debt repayment goal? Most likely.

But all or nothing isn’t the point. It’s the intentionality of the choices. And I’ve come a long way in aligning my life and my choices. As Karen McCall said:

“It’s about what you value. How you obtain as well as where you invest your resources—your time, energy and money—reflects what you value most.”

What do I value most? Nature, people, beauty, adventures. This is where I put my time, energy and money.

And, I’m pretty sure this is how life is a net positive, if we just keep trying.

May you Carpe Dime this week on what you value most.

Love,

Jules

*Yes, shocker, I actually bought things! After four years with $0 for discretionary shopping I didn’t know what to budget, hence the 100x increase—or about $100 per month including half for others and half for me. My most frequent purchases: Outdoor gear, art, books. Technically, home supplies (e.g.: cleaning supplies) and shipping** (e.g.: care packages, greeting cards, stamps) were separate line items. The latter was needed a LOT more than usual last year to stay connected!

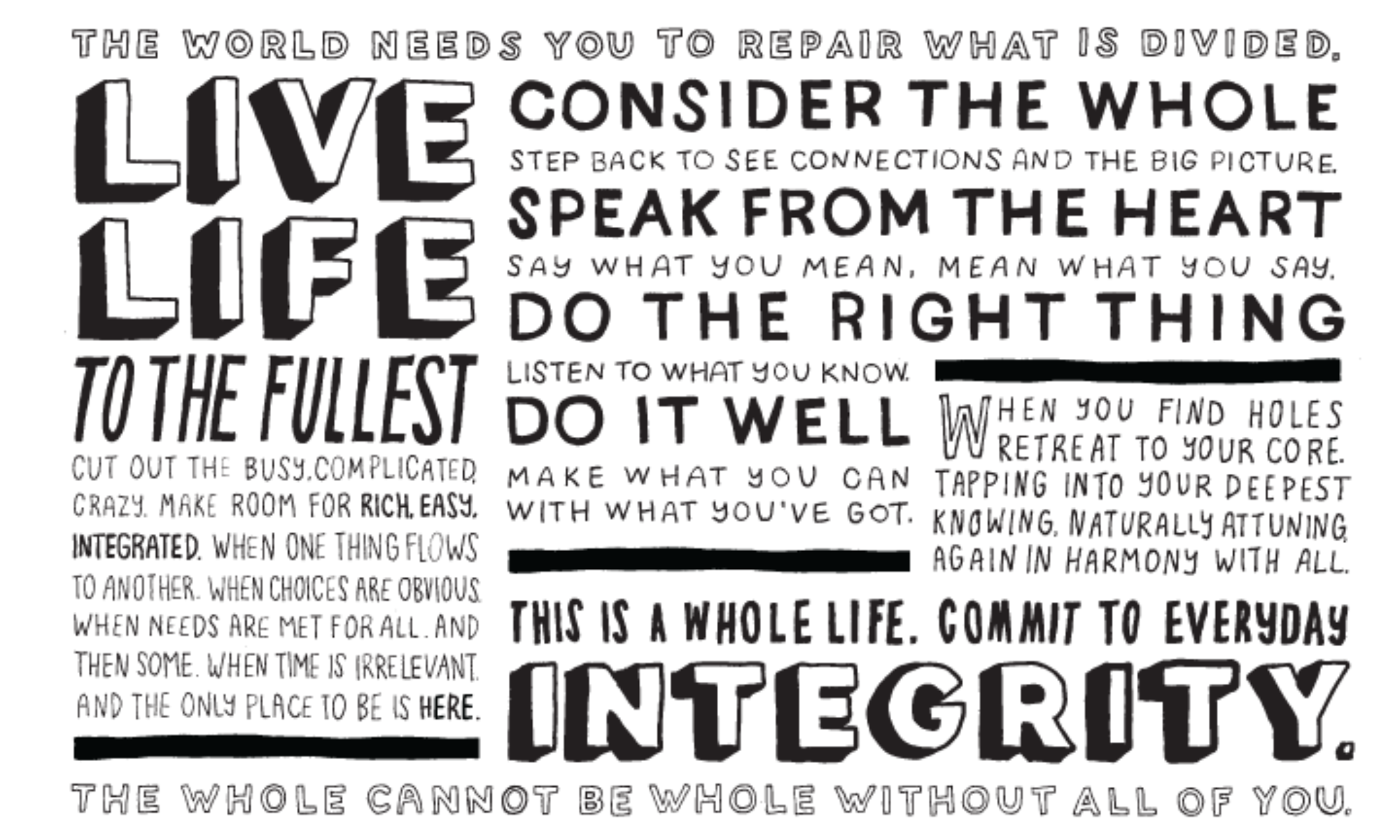

I share a lesson learned about integrity every Monday. Sign up for delivery right to your inbox. Want more? There’s lots more lessons learned here on my blog, so have fun exploring and commenting about your own insights!